The following report was presented during the Global Peace Convention 2010, the annual meeting of the Global Peace Foundation, founded by Dr. Hyun Jin P. Moon.

UN statistics reflect that women represent the overwhelming majority of the world’s poor. Women have a higher unemployment rate than men and receive lower wages when employed. Typically, they are excluded from access to financial services. They are socially disenfranchised, geographically isolated and vastly undereducated compared to men.

UN statistics reflect that women represent the overwhelming majority of the world’s poor. Women have a higher unemployment rate than men and receive lower wages when employed. Typically, they are excluded from access to financial services. They are socially disenfranchised, geographically isolated and vastly undereducated compared to men.

Yet women have emerged as more reliable microfinance clients than men. They were more likely to repay their loans in a timely manner and less likely to default. In one comparison of gender specific lending conducted by the Sinapi Aba Trust (SAT), a microfinance organization in Ghana, SAT found that the arrears rate in their all-male lending facility was 250 percent that of the all-female lending facility.

Evidence from microfinance organizations such as the Women’s Entrepreneurship Development Trust Fund, the UN’s Children’s Defense Fund and UNIFEM found that women’s economic empowerment raises the living standard of the entire household because women are less likely to spend income in a non-productive, short term manner.

“Women’s priorities for spending income are: children, medical services, nutrition, school fees and household needs. Lending to women produces a positive ripple effect of improved health, education and welfare for all household members.” – Women’s Microfinance Initiative

An excellent credit risk from the lender’s standpoint, women have demonstrated that they are:

- co-operative and willingly attend weekly meetings;

- averse to taking undue business risks;

- cautious about extending credit to business customers;

- committed to the mutual guaranty of loans. Lenders have found that a woman will have a very positive attitude about validating the trust which a lender shows to her by making the loan and providing her the opportunity to engage in business ventures previously reserved to men.

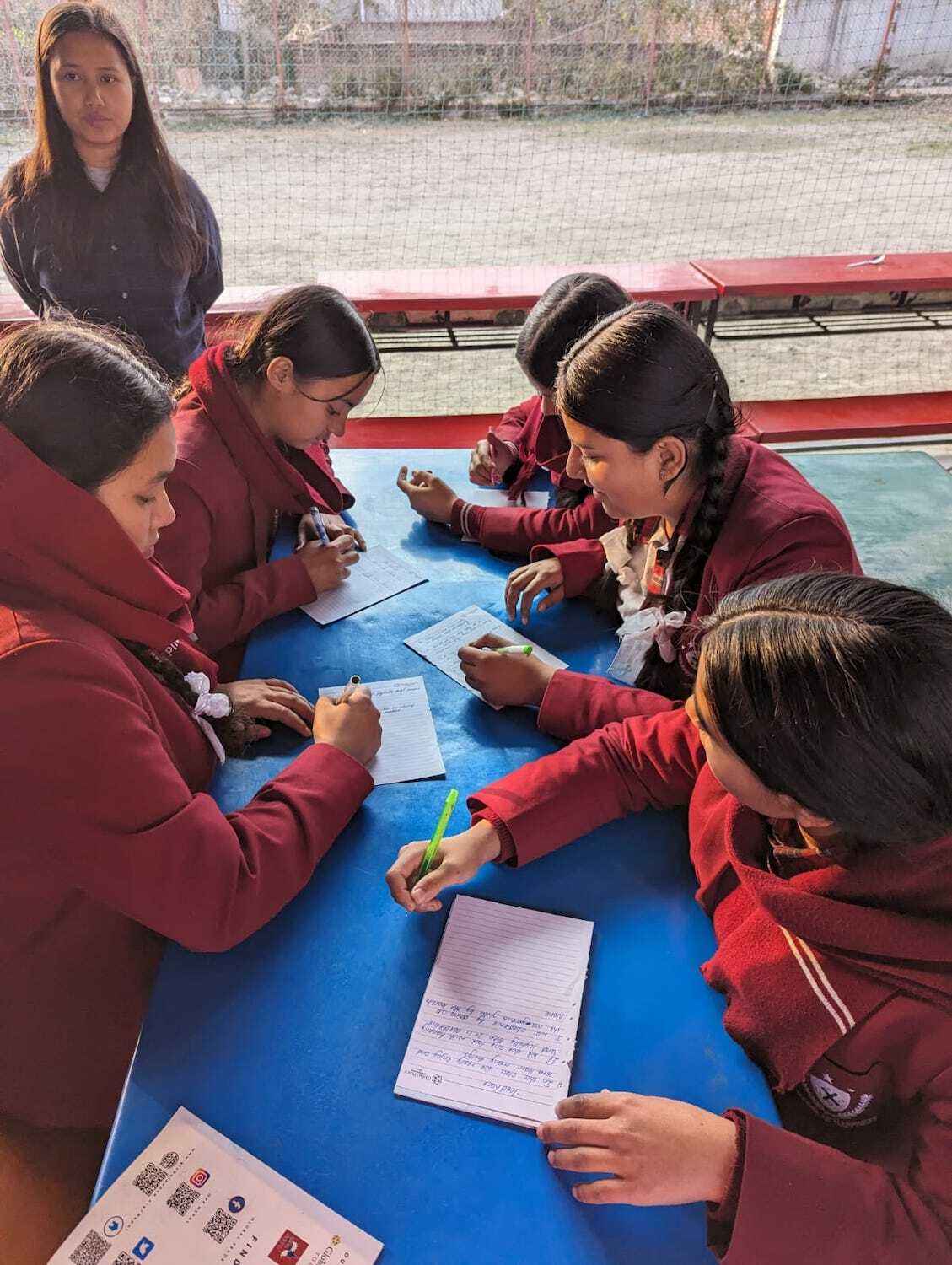

In addition to improving the prospects of the household in general, access to microcredit empowers women. Operating their business requires the women to become skilled in dealing with suppliers, marketers and customers. Learning to negotiate business hurdles improves their decision-making ability. As they become more confident, they are likely to become more involved in their communities and local institutions.

Gradually, these skills can migrate to social and political circles so that women become more adept at advocating for themselves and their families. Microfinance is truly an investment that improves women’s social capital and promotes gender equality through economic success.